This is the third post in The Complete Guide to COL Financial. To read all posts in order, start with Who Can Open An Account then continue reading the rest of the series on this page.

On this post, I’m going to show you how to fill up the COL Application Forms. You can download all the forms, by clicking here. It includes a Customer Account Information Form (2 pages), FATCA Form (1 page) and the Online Securities Trading Agreement (4 pages). The file is in Adobe PDF format, which you can fill up electronically and then print and sign. OR you can print out the file, and fill it up by hand. If you are writing by hand, write legibly in block letters (not script).

We will only be filling up the Customer Account Information Form and FATCA Form. The Online Securities Trading Agreement is for you to read and to keep.

Look at the images first and then read the descriptions that follow.

For INDIVIDUAL Accounts

1 – Tick off the 1st box (Individual). Since, this is an individual application, you need NOT fill out the ‘Secondary Account Holder’ portion.

Personal Information Section

2, 4 & 6 – This is basic stuff. It just asks for your personal details like name, address, contact numbers, etc. If there are parts that do not apply to you, write N/A. (eg. If you are single and unmarried, on the name of spouse, write N/A)

Note: It is important is that the last name and the address on your billing statement matches the last name and the address on your COL application form.

3 – You will be REQUIRED to provide your Philippine Taxpayer Identification Number (TIN) as a pre-requisite to opening your account with COL Financial.

(If you don’t have one, click here to learn how to apply for a TIN. You can also obtain for you TIN online, without going to the BIR office and it is for free. If you already have a TIN and forgot it, you may retrieve it by going to the BIR office. Securing more than one TIN is criminally punishable pursuant to the provisions of the National Internal Revenue Code of 1997, as amended.)

5 – Make sure you put your correct EMAIL ADDRESS. COL Financial is an online brokerage, and hence, most of its correspondence will be via email. (Check your Spam folder as well for COL’s initial email).

Additional Information Section

7 – This 2nd section asks about your employment details. If you are unemployed, just tick off that box and write N/A (Not Applicable) on the other boxes. Otherwise, answer all questions.

Disclosures

8 – The 3rd section is Disclosures. Just answer either yes or no. (If your answer to a question is yes, fill-up the necessary information asked)

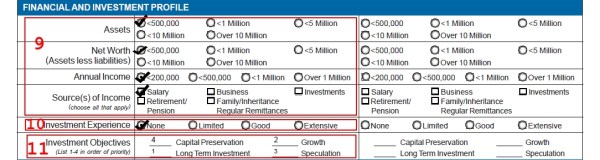

Financial and Investment Profile

9 – This part doesn’t need to be exact. Estimates are acceptable.

10 – If this is your first time to invest in the stock market, check None.

11 – For the ‘Investment Objectives’, all you need is to number them according to your priority.

- ‘Capital Preservation’ means that you want to preserve your capital and intend to solely to avoid risk of loss while beating the inflation rate.. You are investing because you would like to have a guaranteed rate of return or at least just a return of what you originally invested.

- ‘Long-term Investment’ means that you are looking to invest your money for at least 5 years or more with the need to grow, rather than simply preserve, capital in the long term

- ‘Growth’ is you wanting to investing in stocks with strong earnings and/or revenue growth or potential

- ‘Speculation’ is if you have a very aggressive approach to investing. You are willing to take on higher risks, with the hope of a higher rate of investment return, usually by frequent trading.

12 – This is for your bank information. It is NOT mandatory that you have a bank account before you can open a COL account. If you don’t have one (or you just don’t want to divulge the info), you may just write N/A or None if you don’t have one.

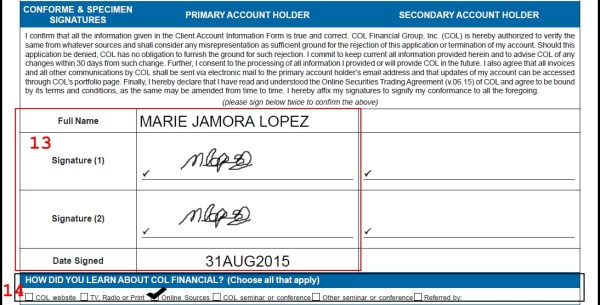

Conforme and Specimen Signature

13 – Write down your name and sign twice on the signature lines. Write the date when you signed the document. Note: It is important is that the signature in your valid government-issued ID matches the signatures in the COL application form.

14 – Tick which one applies to you.

FATCA Form

15 – Just tick which one applies to you. If it is not applicable to you, write N/A or none. If you answered yes to some of the questions, provide the information asked of you and take note that there may be some additional required documents.

16 – Write down your name and sign.

For JOINT Accounts

It is similar to the procedure of INDIVIDUAL Accounts.

For the Customer Account Information Form (CAIF), you need to write down the details of the other party on the ‘Secondary Account Holder’ portion for the Customer (Just 1 CAIF form for the 2 account holders).

For the Foreign Account Tax Compliance Act (FATCA), joint accounts require 2 FATCA forms, 1 per account holder.

Secondary Account Holders may be your spouse, parent, sibling, adult child, a friend, any relative or anyone for that matter.

For In-Trust-For Accounts

For Minors (below 18 yrs), parents may open an ITF Account for them. This is how to fill out the application forms.

Instead of ticking off ‘Individual’, tick off ITF. On the ‘Primary Account Holder’ portion, write the details of the parent. On the ‘Secondary Account Holder’ portion, write the details of the child.

On the signature portion, the adult signs as the Primary Account Holder on the signature lines, and writes the name of the child on the signatures lines of the Secondary Account Holder. Be sure to put on the date when you accomplished the forms.

In addition, the Primary Account Holder must print and sign the Supplementary Form for ITF Accounts, and attach it to the application forms before submitting.

In addition, the Primary Account Holder must print and sign the Supplementary Form for ITF Accounts, and attach it to the application forms before submitting.

There you have it. You’ve filled out the forms…

{Go to the next post: Sending Your Application Forms and Requirements}

COL Financial, Inc. is the recommended Stock Broker of Bro. Bo Sanchez to all his Truly Rich Club members. The TrulyRichClub is a membership Club that he had created to help people achieve Financial Wealth and Spiritual Abundance. It is a private group of individuals who have decided to do something about changing their beliefs and thinking—to gain the abundance mentality they need to change their lives forever. Bro. Bo provides them with the right tools, principles, and strategies to grow in their financial and spiritual life. To join this elite Club, click here.

Hi, what is the required paper size for printing the forma?