Learning how to invest in the stock market is not difficult. You just need to know where to start. On this page, I will share some simple tips to how to get started at growing your money in the stock market.

Learning How to Invest in Stocks Starts with Education

Before you part with any money, it is important to understand any investment. You need to know exactly where your

money is invested and be sure that it matches your financial goals.

Step ONE: Know the Basics

What is Investing?

It’s a pretty simple concept which means that you just set aside a specific amount of money to work for you by making more money for you. It’s committing money with the expectation that the investment will give you a return. And that return can come in the form of an increase in value, additional income or both. When it comes to personal finance, things that people typically invest are in stocks, mutual funds, bonds and real estate.

Why Should I Invest in the Stock Market?

Two Reasons.

First. The stock market has historically given higher average returns than bonds and inflation. Now, just to stress out: the stock market does NOT give guaranteed returns, but over a long period, it also has the HIGHEST potential for returns.

Second. The stock market allows you to buy shares of companies, which normally, ordinary people would not have access to. Being a shareholder, you are essentially a part business owner and potentially entitled to some of the profits (and losses) the business makes. When you buy a stock of the company, you become part owner in these corporations. When they make money, you also make money. Just for a few hundreds of pesos, you get the chance to partner with the owners of big companies like SM, Jollibee, PLDT and many more.

How Does the Stock Market Work?

The stock market is a marketplace where people can buy and sell shares of stock in companies. When you buy a share in a company, you own a piece of the company. Here in the Philippines, companies list – that is, they sell portions of the company– on the Philippine Stock Exchange. They do this to raise capital or funds, instead of borrowing from financial institutions or draining its cash flow.

FYI: “Shares of stock”, “shares”, “stocks” and “equities” are words that are used interchangeably. All of them mean the same thing.

Who is a Stock Broker?

A stockbroker (or trading participant) is a regulated professional individual who buys and sells stocks and other securities on behalf of clients through a stock exchange in return for a fee or commission.

How do I Make Money in the Stock Market?

Remember that in the stock market, you’re buying ownership of businesses. So you make money the same way its business owners make money. These are through dividends and capital gains.

So, what are dividends? All it refers to is the payment that a company makes to its shareholders. So rather than invest all the money that the business makes, a company might make the choice to return some of that cash to its shareholders and that’s a dividend. Which sounds like passive income.

The second way is through capital appreciation. If you buy into a quality business, you are hoping that the company continue to grow and expand in producing more goods or services. The share price goes up in value and you experience capital growth of the share. Capital appreciation simply means that the company you own is worth more than when you bought it.

How Much Money Can I Make in the Stock Market?

It depends. It’s always a percentage of the amount of money you put in.

Below is a graph of the Philippine Stock Exchange Index (PSEi) as of June 30, 2016. It is an indicator on how the Philippine economy performed over the years. Simply, the higher it is, then the better our country’s economy is – which means it might be a good time to start investing (although I believe it’s always a good time to invest).

source: tradingeconomics.com

Isn’t the Stock Market Risky?

The Philippine stock market is risky but risk can be managed when you know what you are doing and having a strategy. One strategy that I have used is the SAM or the strategic averaging method by the Truly Rich Club- wherein I choose blue chip reputable companies and buy them at a certain price.

Step TWO: Determine How You Want to Invest in the Stock Market

There are two affordable ways of investing in the stock market: through mutual funds or through an online broker.

If you’re going the route of investing in mutual funds, the money you invest is pooled together with the money collected from other investors. This pooled money is then managed by a professional fund manager. There are mainly four types of mutual funds in the Philippines: stock (or equity), bond, balanced, and money market. If you want to invest in the stock market through mutual funds, choose stock or equity funds. Stock or equity funds invest in shares of stock of Philippine corporations listed in the Philippine Stock Exchange.

Equity Funds are great for those who want to convenience of having someone manage your investment for you. Less hassle. But can cost a little more than an online broker due to management fees and commissions.

Related Post: WHAT are Mutual Funds?

If you’d rather invest in individual stocks, you will want to choose an online broker. Through them, you are able to buy and sell stocks as long as you have a computer with internet access. Though most online brokers charge reasonably low fees, you are personally responsible for managing your stock investments.

Step THREE: Check If You Are Financially Ready to Invest in the Stock Market

Do you have an investment goal? It is important to know where you will be using your money in the future. Ask yourself why you want to invest and what you expect to gain from it. The stock market can be very volatile. If you are looking to cash in right away, the stock market might not be a good place to put your money. So your money invested the stock market should be for a long-term goal, like more than 10 years or so. So only invest money that your don’t need within the near future.

Do you have any debts? Don’t invest if you are trying to get out of debt. Make sure any high-interest debts are taken care of before investing in the stock market.

Do you have an emergency fund? Have an emergency fund to act as your safety net, so that in case of emergencies, you won’t need to borrow from the stock investments you already have.

Are you protected by insurance? Like having an emergency fund, you need to avail of insurance to protect you from the bigger emergencies like house fires, medical problems, etc. Having insurance protects you from having the sudden need for cash.

Step FOUR: Open a Brokerage Account

Check this link: List of Online Stock Brokers in the Philippines

Do I Physically Go Somewhere to Invest?

NO! In fact, you can invest from the comfort of your own home. There are a ton of online brokerage accounts free to choose from and each of them have different fees, different minimum balances, etc.

Personally, I use COL Financial and so far, I’ve been very satisfied with their services. They are the largest online brokerage in the country. They are also the most active when it comes to promoting stock market education. They hold introductory stock market seminars every week at their office.

Click here to GET STARTED on opening a COL Financial Account.

Can I Open a Stock Brokerage Account While I’m Abroad?

YES! But, you usually have to mail the original signed application forms and documents to your stock broker. For more information about this, you can send an email to helpdesk@colfinancial.com.

Do You Need a Lot of Money to Start Investing in the Stock Market?

NO! You can start for as low as Php 5000 with an online broker. But, investing with Php 5000, won’t make you millionaire. So, you should still regularly add to your initial investment to make your capital grow.

Step FIVE: Have an Investing Strategy

What Investment Strategy Is Best In The Stock Market?

There are three basic investing strategies: buy and hold, peso cost averaging and market timing.

The “buy and hold” approach to investing in stocks assumes that in the long term (over the course of, say, 10 or more years) stock prices will go up. If you choose this strategy, pick a blue chip company, buy its stocks, hold onto it long enough, and sell it only when you want to get your money.

The “peso cost averaging” approach is done by investing a fixed amount of money at fixed intervals, regardless of it’s price. The objective of this strategy is to lower the total average cost per unit/shares of the investment.

The “market timing” approach believes that it is possible to predict when the market, or certain stocks, will rise and fall. It therefore makes sense to buy when the markets are low and to sell when they are high in order to maximize profits. Investors who choose this strategy use indicators and other tools to predict where the market is going – technical analysis, fundamental analysis, or even intuition.

My Current Investment Strategy

For newbies on direct stock investing, I recommend to join the Truly Rich Club so you can get expert guidance on what stocks to buy and when to sell them. They are actually the main reason why I felt confident and safe with my first stock picks. One of the membership benefits of the club is the Stocks Update. The Stocks Update is a newsletter that give specific advice on (1) what stocks to buy, (2) at what prices to buy them, and (3) at what price to sell them. There’s a catch though, subscription fee starts from Php 500 or so.

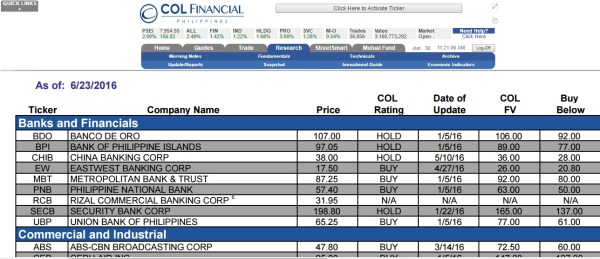

But if you don’t want to pay for the Truly Rich Club Subscription, if your online broker is COL Financial, you get access to their FREE Investment Guide Recommendations. It’s a list of pre-selected companies by COL that are ‘good’ for the peso cost averaging strategy.

I hope that this guide has been helpful for you. Happy Investing!

Photo Credits for Definitions: Rappler

Photo Credit: Flickr